Topline

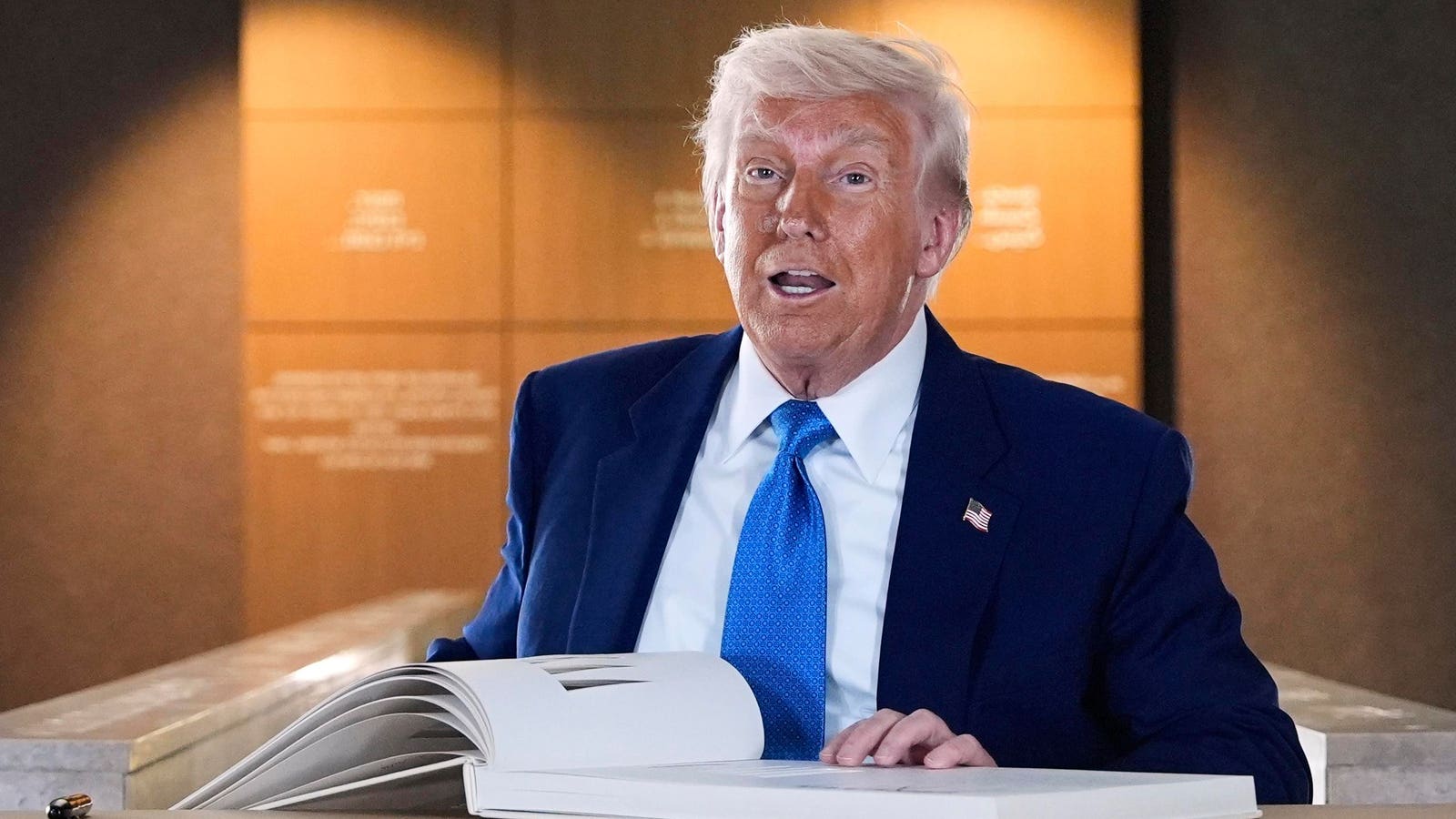

Consumer sentiment dropped to its lowest level since June 2022 this month, according to the University of Michigan’s survey released Friday morning, reflecting uncertainty around President Donald Trump’s tariff plan and its impact on the global economy.

CHICAGO, ILLINOIS – MARCH 12: A customer shops for eggs at a grocery store on March 12, 2025 in … More Chicago, Illinois. (Photo by Scott Olson/Getty Images)

Key Facts

The consumer sentiment index’s preliminary reading of 50.8 for April dropped from last month’s 57, coming in below economists’ consensus forecast of 54.

The index, which uses a phone survey to collect Americans’ thoughts on economic indicators such as inflation and interest rates, provides a timely look at the consumer attitudes and expectations driving economic activity.

Interviews were conducted from March 25 to April 8, a timeframe that started with a bit of market volatility as the future of U.S. trade policy remained largely unclear to investors until Trump’s “Liberation Day” on April 2, when the president announced a tariff plan that sent markets plummeting until Tuesday.

Consumers cited personal finances, incomes and inflation as warning signs that raise the risk of recession, according to Surveys of Consumers Director Joanne Hsu who said “the share of consumers expecting unemployment to rise in the year ahead increased for the fifth consecutive month and is now more than double the November 2024 reading and the highest since 2009.”

April’s survey results come after a milder-than-expected inflation report on Thursday, with core inflation hitting a four-year low of 2.8% according to the Bureau of Labor Statistics’ consumer price index, still above the Federal Reserve’s target inflation rate of 2%.

News Peg

The index report was released on the tail of a roller coaster week for global markets. On April 2, Trump announced a lofty tariff plan on imported goods from dozens of nations ranging from a base 10% tariff to 50% as part of the president’s efforts to bolster U.S. manufacturing. Stocks went into a free fall for almost a full trading week as recession odds grew amid investors and economists expectations that tariffs will elevate the price of goods. Then, Trump announced Wednesday he was putting a 90-day pause on many of the tariffs, resulting in a market rally. On Friday after the opening bell, the major U.S. indexes were relatively flat.

Big Number

30%. That’s how much consumer sentiment is down in April compared to the end of the Biden administration in January, according to the University of Michigan’s survey. The index was at 73.2 on Jan. 10, the final reading of then-President Joe Biden’s tenure. Since then, Trump has signed 112 executive orders, including the sweeping tariff plan, with many of them relating to economic policy.

Further Reading

Forbes Recession Tracker: JPMorgan’s Jamie Dimon Says Recession ‘Probably’ Coming (Forbes)

Core Inflation Hit 4-Year Low Of 2.8% In March—But Tariffs Still Loom (Forbes)

Trump Approval Rating Tracker: Three Post-Tariff Surveys Show Decline (Forbes)