Topline

Expedia shares were down 8% Friday morning after its Q1 report echoed the warning siren of major airlines, hotel companies and state and local tourism organizations—as they experience lower demand for travel both by Americans and inbound international visitors.

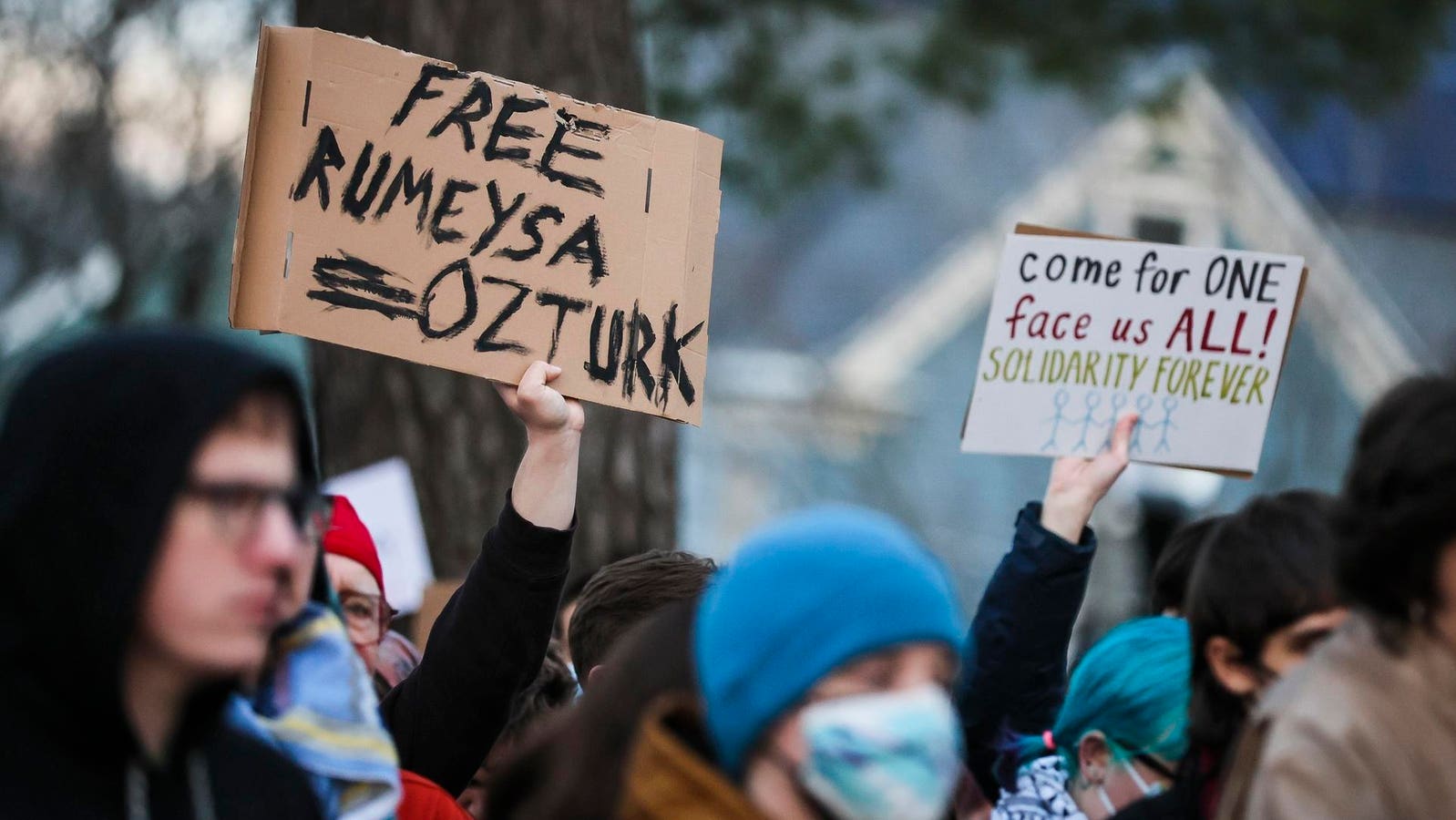

Expedia Group share price fell Thursday following reports of softer demand for the rest of 2025. … More (Image: Mateusz Slodkowski)

Key Facts

Expedia Group’s revenue in the first three months of the year grew by 3%—at the lower end of the company’s forecast—and it missed its sales target “due to weaker than expected travel demand in the U. S. and into the U.S.,” CEO Ariane Gorin told investors Thursday afternoon, adding that “U.S. demand was soft, driven by declining consumer sentiment, and we saw pressure on key inbound U.S. corridors.”

Two-thirds of Expedia’s business comes from the U.S. and the firm saw inbound international travel drop 7% in Q1, while inbound bookings from Canada dropped 30%.

Expediaʼs stock slumped 8% Friday morning based on softer Q2 projections, with Gorin telling investors April was “somewhat softer than March” and the company was downgrading its full-year guidance.

“Expedia’s higher exposure to the U.S. is not ideal given the current backdrop,” J.P. Morgan analyst Doug Anmuth said in a note to investors Friday morning.

“The commentary around inbound travel and the [business-to-consumer] business was discouraging and suggests a tough slog from here,” Piper Sandler analyst Thomas Champion wrote in a research note late Thursday, adding “it could also get incrementally worse.”

Key Background

Along with travel booking companies, U.S. tourism authorities across the country are seeing weaker demand, both for Americans traveling domestically and inbound international travel. In the first quarter of 2025, the Las Vegas tourism bureau reported a 7% in visitor volume with 9.7 million fewer visitors compared to the first quarter last year, the Las Vegas Review-Journal reported. After reporting a record-breaking $157 billion in tourism revenue in 2024, California forecasts a 1% dip in overall visitation and a 9.2% decline in international visitation in 2025, “in direct response to federal economic policy and an impending ‘Trump Slump,’” Governor Gavin Newsom said in a statement. It all adds up: in 2024, travelers in the United States directly spent $1.3 trillion, producing an economic output of $2.9 trillion and supporting more than 15 million American jobs, according to the U.S. Travel Association (USTA).

Where Did The Term “trump Slump” Originate?

It’s not new. The U.S. also experienced a decline in inbound tourism during Trump’s first term, when the volume of international visitors fell by 4% in the first seven months of 2017, according to data from the U.S. National Travel & Tourism Office. At that time, the tourism industry dubbed the decline a “Trump slump,” connecting the decline to the president’s America First anti-immigrant rhetoric and more restrictive visa rules for some countries. By spring of 2017, “Trump Slump” was appearing regularly in headlines in NBC News, the BBC and other news outlets.

What’s Different About The “trump Slump” This Time Around?

The second “Trump Slump” is significantly worse than during the president’s first term. Last year, 20.4 million Canadian travelers—the largest source market for inbound U.S. tourism—contributed $20.5 billion to the U.S. economy. This year, Canadians, largely turned off by Trump’s “51st state” rhetoric, are bypassing the U.S. in favor of Mexico, the Caribbean and other destinations. In March—even before Trump’s tariffs were announced, the number of Canadians taking road trips into the U.S.—representing the majority of Canadians who visit—dropped by 32% year over year, according to data from Statistics Canada, which also reported a 13.5% decline in U.S.-bound air travelers from Canada that month. Also in March, inbound tourism had plummeted from Europe (down 17%), South America (down 10%) and other regions, according to the U.S. Commerce Department. The USTA calculates that every 1% drop in international visitors translates to $1.8 billion lost in export revenue annually, noting that if the trend continues, the U.S. stands to lose at least $21 billion in travel-related exports this year.

Tangent

Major airlines were the first to observe a downward shift in travel demand as bookings took a 6% nosedive in the days immediately following President Donald Trump’s tariff announcement on April 2, according to an analysis of over 110 million anonymized credit and debit cards by Consumer Edge, a provider of consumer spending data. Major hospitality corporations have also downgraded their guidance for 2025, citing uncertainty in the macro environment and declining demand.

Further Reading

How Trump Is Torpedoing Foreign Tourism To The US—Potentially For Years To Come, Say Analysts (Forbes)

Trump’s Tariffs Sent U.S. Airline Bookings Into A Tailspin, New Data Show (Forbes)